Nevada

Our mission is to save lives by meeting the most critical needs of our communities and investing in breakthrough research to prevent and cure breast cancer.

Nevada

Our mission is to save lives by meeting the most critical needs of our communities and investing in breakthrough research to prevent and cure breast cancer.

Need Help?

Call our breast care helpline to assist with finding local screening and diagnostic facilities or clinical research trials, requesting financial assistance, or other questions or care needs.

Get Involved

Help us reach our vision of a world without breast cancer by getting involved in our local community.

Make a BIG Impact as a BigWig

Each year, passionate local leaders and community members serve as representatives in the fight against breast cancer by committing to being a Susan G. Komen BigWig. While it may be a funny name, as a BigWig you can make a real difference – all while having fun!

Contact us to learn more

Thank You Kay’s Power Play Fund

Generous donors and programs like Kay’s Power Play Fund help support Komen’s Patient Care Center. The Komen Patient Care Center is your trusted, go-to source for timely, accurate breast health and breast cancer information, services and resources. Our navigators offer free, personalized navigation services to patients, caregivers, and family members.

Learn More

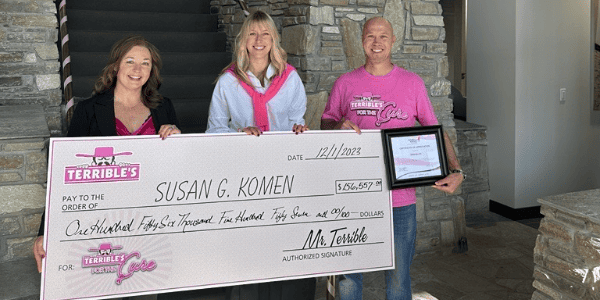

Thank You to Terrible's!

Through their Breast Cancer Awareness Month efforts in 2023, the Terrible’s raised over $156,000.Thanks to partnerships like Terrible’s, we continue to move forward toward a breast cancer-free world. Discover more about our employee engagement program or contact our Komen staff partner to learn more about how you can partner with Komen.

Connect with Jill and learn moreLocal Events

Join the fight to end breast cancer by attending an event in Nevada!

Questions? Contact Us

ShareForCures

Your breast cancer information is as unique as you are. When combined with thousands of other ShareForCures members, you provide scientists with a more diverse set of data to make new discoveries, faster.

Latest News & Information

Nikki’s Story: I’m Not Going to Let Cancer Steal My Sparkle

Nikki Anderson’s cancer journey began with a uterine cancer diagnosis in her 30s, which was followed by a breast cancer diagnosis six years later. She celebrates her journey by fundraising for the Komen 3-Day with Team Sparkle, inspired by her own adage: “I’m not going to let cancer steal my sparkle.”

The post Nikki’s Story: I’m Not Going to Let Cancer Steal My Sparkle appeared first on Susan G. Komen®.

Susan G. Komen® Peoria MORE THAN PINK Walk Raises Funds for Breast Cancer Patient Care Services in Illinois

Susan G. Komen®, the world’s leading breast cancer organization, will hold the Susan G. Komen Peoria MORE THAN PINK Walk on Saturday, May 11, 2024, at Metro Centre. This signature event enables Komen to raise critical funds that provide direct support to breast cancer patients, fund groundbreaking research, empower health equity initiatives nationwide, and advocate […]

The post Susan G. Komen® Peoria MORE THAN PINK Walk Raises Funds for Breast Cancer Patient Care Services in Illinois appeared first on Susan G. Komen®.

Nevada

Contact Us

Susan G. Komen Nevada

Executive Director, Inland Empire & Nevada: Jill Eaton

Email: jeaton@komen.org

Phone: 951-394-3048